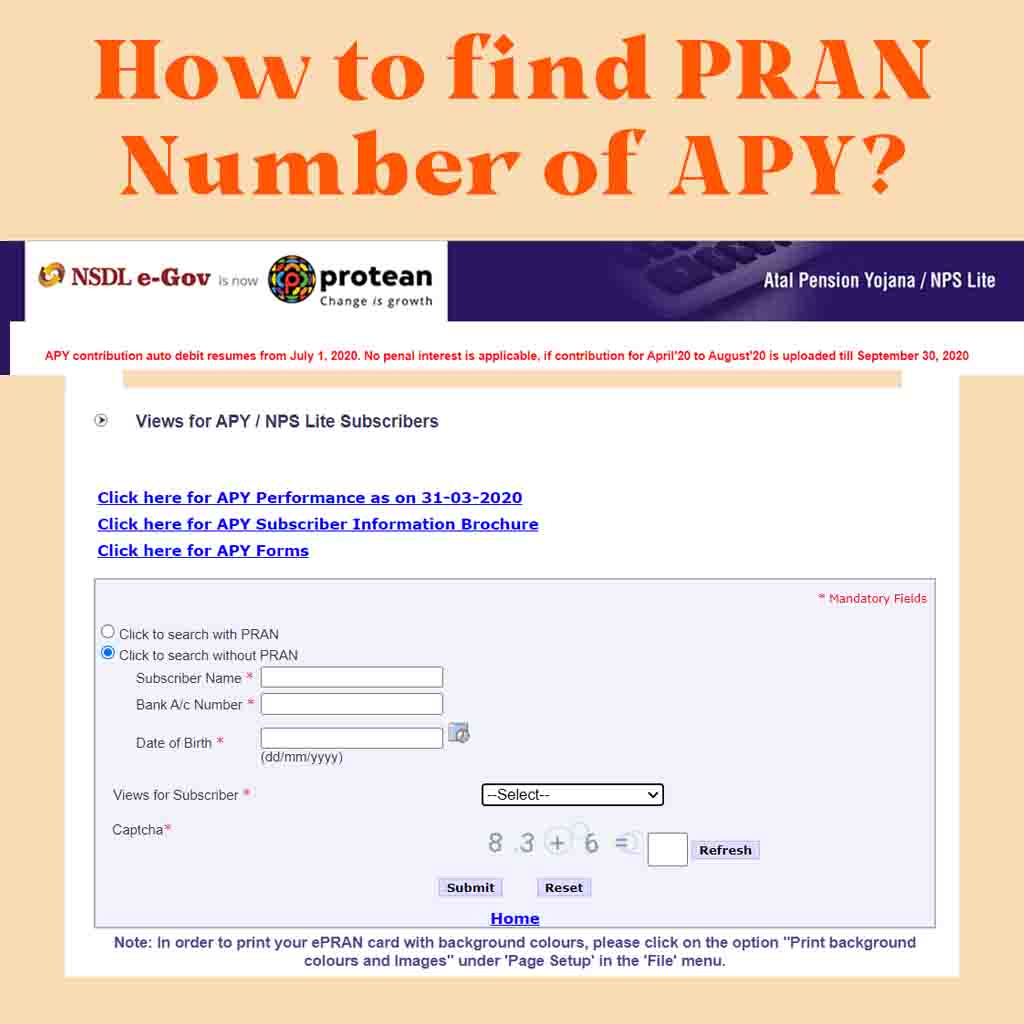

Understanding the Atal Pension Yojana Scheme Chart: A Step-by-Step Guide

The Atal Pension Yojana (APY) scheme is a pension scheme launched by the Government of India in 2015. The scheme is designed to provide a pension to people in the unorganized sector who do not have access to any formal pension scheme. The scheme offers a guaranteed pension to its subscribers, and the pension amount depends on the contribution made and the age of the subscriber at the time of joining. In this blog post, we will discuss the Atal Pension Yojana scheme chart, which is a step-by-step guide to help you understand how the scheme works.

Eligibility

The first step in the APY scheme chart is eligibility. To be eligible for the APY scheme, you must be an Indian citizen between the ages of 18 and 40. You must have a savings bank account, and the bank account should be linked to Aadhaar. If you meet these criteria, you can proceed to the next step.

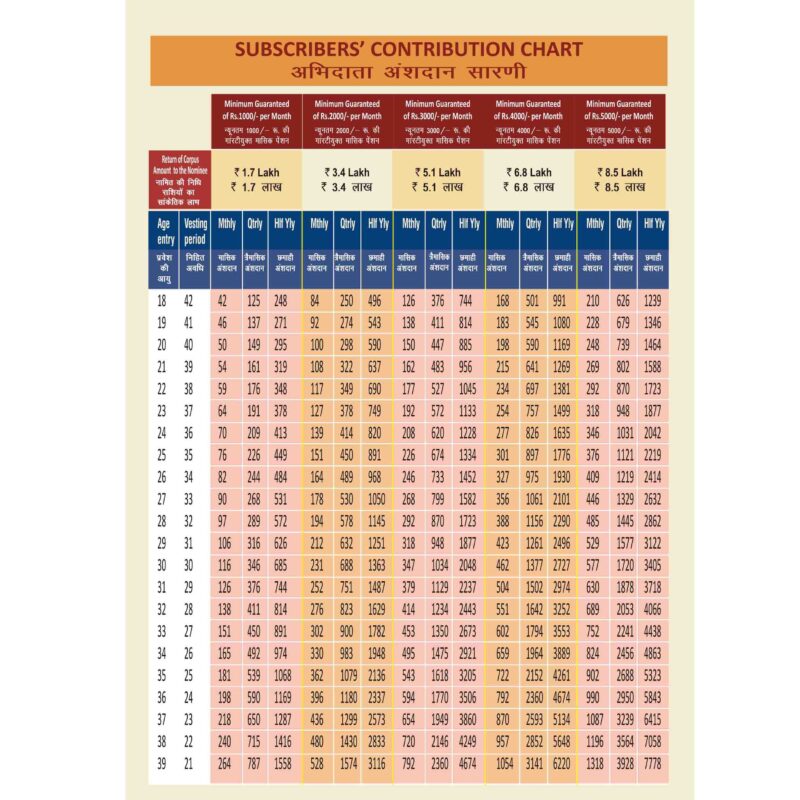

Choosing the Pension Amount

The second step in the APY scheme chart is choosing the pension amount. The pension amount ranges from Rs. 1000 to Rs. 5000 per month, depending on the contribution made and the age of the subscriber at the time of joining. To calculate the contribution amount, the subscriber needs to choose the pension amount they want to receive and their age at the time of joining.

For example, if a subscriber wants to receive a pension of Rs. 3000 per month and is 30 years old at the time of joining, the contribution amount will be Rs. 577 per month.

Choosing the Contribution Frequency

The third step in the APY scheme chart is choosing the contribution frequency. The subscriber can choose to contribute on a monthly, quarterly, or half-yearly basis, depending on their convenience.

Atal Pension Yojana SCHEME Chart

Rs. 1000 per month

Below calculator provides the approx monthly payment you would have to make to get a Atal pension of Rs 1000 each month. Basically if you start early you will have to pay less monthly and if you start late you have to pay more.

| Age of Customer | Years to invest | Monthly Payment | Pension Amount | Return to nominee |

| 18 | 42 | 42 | 1000 | 1.7 Lakh |

| 19 | 41 | 45.9 | 1000 | 1.7 Lakh |

| 20 | 40 | 50 | 1000 | 1.7 Lakh |

| 21 | 39 | 54.7 | 1000 | 1.7 Lakh |

| 22 | 38 | 59 | 1000 | 1.7 Lakh |

| 23 | 37 | 64.6 | 1000 | 1.7 Lakh |

| 24 | 36 | 70 | 1000 | 1.7 Lakh |

| 25 | 35 | 76 | 1000 | 1.7 Lakh |

| 26 | 34 | 82.5 | 1000 | 1.7 Lakh |

| 27 | 33 | 89.7 | 1000 | 1.7 Lakh |

| 28 | 32 | 97.6 | 1000 | 1.7 Lakh |

| 29 | 31 | 107.2 | 1000 | 1.7 Lakh |

| 30 | 30 | 116 | 1000 | 1.7 Lakh |

| 31 | 29 | 127 | 1000 | 1.7 Lakh |

| 32 | 28 | 139 | 1000 | 1.7 Lakh |

| 33 | 27 | 152 | 1000 | 1.7 Lakh |

| 34 | 26 | 166 | 1000 | 1.7 Lakh |

| 35 | 25 | 181 | 1000 | 1.7 Lakh |

| 36 | 24 | 198 | 1000 | 1.7 Lakh |

| 37 | 23 | 218 | 1000 | 1.7 Lakh |

| 38 | 22 | 240 | 1000 | 1.7 Lakh |

| 39 | 21 | 265 | 1000 | 1.7 Lakh |

| 40 | 20 | 291 | 1000 | 1.7 Lakh |

Similar calculation can be done for amount 2000. You just need to multiply column 3, 4 & 5 by 2 and you will get the amount.

Rs. 2000 per Month

Atal Pension Yojana calculator to get Rs 2000 monthly pension

| Age of Customer | Years to invest | Monthly Payment | Pension Amount | Return to nominee |

| 18 | 42 | 84 | 2000 | 3.4 Lakh |

| 19 | 41 | 91.8 | 2000 | 3.4 Lakh |

| 20 | 40 | 100 | 2000 | 3.4 Lakh |

| 21 | 39 | 109.4 | 2000 | 3.4 Lakh |

| 22 | 38 | 118 | 2000 | 3.4 Lakh |

| 23 | 37 | 129.2 | 2000 | 3.4 Lakh |

| 24 | 36 | 140 | 2000 | 3.4 Lakh |

| 25 | 35 | 152 | 2000 | 3.4 Lakh |

| 26 | 34 | 165 | 2000 | 3.4 Lakh |

| 27 | 33 | 179.4 | 2000 | 3.4 Lakh |

| 28 | 32 | 195.2 | 2000 | 3.4 Lakh |

| 29 | 31 | 214.4 | 2000 | 3.4 Lakh |

| 30 | 30 | 232 | 2000 | 3.4 Lakh |

| 31 | 29 | 254 | 2000 | 3.4 Lakh |

| 32 | 28 | 278 | 2000 | 3.4 Lakh |

| 33 | 27 | 304 | 2000 | 3.4 Lakh |

| 34 | 26 | 332 | 2000 | 3.4 Lakh |

| 35 | 25 | 362 | 2000 | 3.4 Lakh |

| 36 | 24 | 396 | 2000 | 3.4 Lakh |

| 37 | 23 | 436 | 2000 | 3.4 Lakh |

| 38 | 22 | 480 | 2000 | 3.4 Lakh |

| 39 | 21 | 530 | 2000 | 3.4 Lakh |

| 40 | 20 | 582 | 2000 | 3.4 Lakh |

Rs. 3000 per month

Atal pension yojana investment required to get Rs 3000 pension

| Age of Customer | Years to invest | Monthly Payment | Pension Amount | Return to nominee |

| 18 | 42 | 126 | 3000 | 5.1 Lakh |

| 19 | 41 | 137.7 | 3000 | 5.1 Lakh |

| 20 | 40 | 150 | 3000 | 5.1 Lakh |

| 21 | 39 | 164.1 | 3000 | 5.1 Lakh |

| 22 | 38 | 177 | 3000 | 5.1 Lakh |

| 23 | 37 | 193.8 | 3000 | 5.1 Lakh |

| 24 | 36 | 210 | 3000 | 5.1 Lakh |

| 25 | 35 | 228 | 3000 | 5.1 Lakh |

| 26 | 34 | 247.5 | 3000 | 5.1 Lakh |

| 27 | 33 | 269.1 | 3000 | 5.1 Lakh |

| 28 | 32 | 292.8 | 3000 | 5.1 Lakh |

| 29 | 31 | 321.6 | 3000 | 5.1 Lakh |

| 30 | 30 | 348 | 3000 | 5.1 Lakh |

| 31 | 29 | 381 | 3000 | 5.1 Lakh |

| 32 | 28 | 417 | 3000 | 5.1 Lakh |

| 33 | 27 | 456 | 3000 | 5.1 Lakh |

| 34 | 26 | 498 | 3000 | 5.1 Lakh |

| 35 | 25 | 543 | 3000 | 5.1 Lakh |

| 36 | 24 | 594 | 3000 | 5.1 Lakh |

| 37 | 23 | 654 | 3000 | 5.1 Lakh |

| 38 | 22 | 720 | 3000 | 5.1 Lakh |

| 39 | 21 | 795 | 3000 | 5.1 Lakh |

| 40 | 20 | 873 | 3000 | 5.1 Lakh |

Rs. 4000 per month

Atal pension yojana investment required to get Rs 4000 pension

| Age of Customer | Years to invest | Monthly Payment | Pension Amount | Return to nominee |

| 18 | 42 | 168 | 4000 | 6.8 Lakh |

| 19 | 41 | 183.6 | 4000 | 6.8 Lakh |

| 20 | 40 | 200 | 4000 | 6.8 Lakh |

| 21 | 39 | 218.8 | 4000 | 6.8 Lakh |

| 22 | 38 | 236 | 4000 | 6.8 Lakh |

| 23 | 37 | 258.4 | 4000 | 6.8 Lakh |

| 24 | 36 | 280 | 4000 | 6.8 Lakh |

| 25 | 35 | 304 | 4000 | 6.8 Lakh |

| 26 | 34 | 330 | 4000 | 6.8 Lakh |

| 27 | 33 | 358.8 | 4000 | 6.8 Lakh |

| 28 | 32 | 390.4 | 4000 | 6.8 Lakh |

| 29 | 31 | 428.8 | 4000 | 6.8 Lakh |

| 30 | 30 | 464 | 4000 | 6.8 Lakh |

| 31 | 29 | 508 | 4000 | 6.8 Lakh |

| 32 | 28 | 556 | 4000 | 6.8 Lakh |

| 33 | 27 | 608 | 4000 | 6.8 Lakh |

| 34 | 26 | 664 | 4000 | 6.8 Lakh |

| 35 | 25 | 724 | 4000 | 6.8 Lakh |

| 36 | 24 | 792 | 4000 | 6.8 Lakh |

| 37 | 23 | 872 | 4000 | 6.8 Lakh |

| 38 | 22 | 960 | 4000 | 6.8 Lakh |

| 39 | 21 | 1060 | 4000 | 6.8 Lakh |

| 40 | 20 | 1164 | 4000 | 6.8 Lakh |

Rs. 5000 per month

Atal pension yojana investment required to get Rs 5000 pension

| Age of Customer | Years to invest | Monthly Payment | Pension Amount | Return to nominee |

| 18 | 42 | 210 | 5000 | 8.5 Lakh |

| 19 | 41 | 229.5 | 5000 | 8.5 Lakh |

| 20 | 40 | 250 | 5000 | 8.5 Lakh |

| 21 | 39 | 273.5 | 5000 | 8.5 Lakh |

| 22 | 38 | 295 | 5000 | 8.5 Lakh |

| 23 | 37 | 323 | 5000 | 8.5 Lakh |

| 24 | 36 | 350 | 5000 | 8.5 Lakh |

| 25 | 35 | 380 | 5000 | 8.5 Lakh |

| 26 | 34 | 412.5 | 5000 | 8.5 Lakh |

| 27 | 33 | 448.5 | 5000 | 8.5 Lakh |

| 28 | 32 | 488 | 5000 | 8.5 Lakh |

| 29 | 31 | 536 | 5000 | 8.5 Lakh |

| 30 | 30 | 580 | 5000 | 8.5 Lakh |

| 31 | 29 | 635 | 5000 | 8.5 Lakh |

| 32 | 28 | 695 | 5000 | 8.5 Lakh |

| 33 | 27 | 760 | 5000 | 8.5 Lakh |

| 34 | 26 | 830 | 5000 | 8.5 Lakh |

| 35 | 25 | 905 | 5000 | 8.5 Lakh |

| 36 | 24 | 990 | 5000 | 8.5 Lakh |

| 37 | 23 | 1090 | 5000 | 8.5 Lakh |

| 38 | 22 | 1200 | 5000 | 8.5 Lakh |

| 39 | 21 | 1325 | 5000 | 8.5 Lakh |

| 40 | 20 | 1455 | 5000 | 8.5 Lakh |

Related Articles

Conclusion

The Atal Pension Yojana scheme chart is a step-by-step guide to help you understand how the scheme works. The scheme is designed to provide financial security to people in the unorganized sector who do not have access to any formal pension scheme. The scheme offers a guaranteed pension to its subscribers, and the pension amount depends on the contribution made and the age of the subscriber at the time of joining. If you are between the ages of 18 and 40 and do not have access to any formal pension scheme, you should consider joining the Atal Pension Yojana scheme and secure your retirement.